Better Employee Experiences With Financial Initiatives

Financial planning initiatives are a tried and tested way to reward employees for great performance. But they can also go beyond this and help to create better employee experiences. This guide explores how you can tie performance to financial success, using the right tools to deliver results. Attracting and retaining top talent requires more than simply addressing the way people are managed. It also means rethinking how financial incentives are used. Connecting strategic HR initiatives to financial rewards can create better employee experiences. Financial incentives can:

- Increase employee satisfaction.

- Improve productivity.

- Motivate employees to achieve company goals.

- Show recognition for great performance.

- Encourage teamwork.

There are challenges to making sure these incentives are delivered effectively. Choosing the best incentives for a given situation is crucial, and these can vary depending on the work environment or type of business. One of the most effective ways to use financial incentives is to tie them closely to employee performance. As a study from the Journal of Applied Psychology points out, “the more closely the financial incentives are tied to performance, the greater the improvement on a variety of outcomes". On the other hand, failure to tie incentives to performance can lead to problems. The study continues: “when a weak pay-for-performance link exists, turnover of the best people may occur because they perceive that their high performance will not be sufficiently rewarded”. This article will explain how you can make sure this link between performance and incentives drive the best decisions around compensation. We’ll explore how you can lay the groundwork with financial forecasting, and the tools you can use to accurately assess performance.

Here are 4 steps you can follow to make sure your financial incentives deliver better employee experiences:

1. Start with financial forecasting

Before you can decide what funds to use for financial incentives, you need to figure out how much money is available. Financial forecasting software allows you to assess your potential expenses and budget your rewards accordingly. Financial forecasting software can:

- Predict revenue and future costs.

- Generate reports related to Statement of Cash Flows and Balance Sheets.

- Avoid duplication of work and calculations.

- Assist with collaboration between departments.

- Keep a centralized view of the overall plan.

- Give a better understanding of risks and opportunities.

- Forecast cash flows from various areas of the company.

- Help predict unexpected trends.

Once you know your budgets and your targets you can then start linking them to performance. Next, we’ll look at how performance management software can be used to identify high performing individuals and teams.

2. Link financial success to employee performance

Once a budget for financial initiatives has been arrived at, it’s time to assess employee performance. Performance management software can be used to collect data on a wide range of metrics, from completion of goals to how well an employee works with others. You can use this data to link your employee reviews to decisions around financial incentives. When linking financial rewards to performance it’s important to make this non-competitive and supportive. A competitive, ratings-focused approach to performance management can negatively impact collaboration. Performance-related data also allows you to tie financial initiatives to teams and departments. This approach delivers shared rewards for shared goals, leading to improvements in teamwork and morale.

One-off bonus payments

One-off bonus payments are a common form of financial benefit used to reward outstanding performance. These payments are often linked to high standards of work on special projects or assignments, rather than a reflection of additional hours worked. Bonus payments can also be awarded at regular intervals, for instance as part of employee appraisals. In this case, managers should be clear as to the expectations for such payments, so they can be distributed fairly.

Pay increase

Pay increases are closely linked to performance, with increased salaries reflecting improvements. Such improvements in performance can be agreed upon between managers and their employees so that expectations are clear.

For example, this can be linked to an employee’s Personal Development Plan (PDP), with goals based on productivity and skills. As with bonus payments, pay increases should be fair and open to all employees. This means avoiding a “winner takes all” approach, as well as competitive “forced ranking” in staff appraisals.

The right pay rates

Employees are more likely to feel valued when they know they are being paid the right rates. This means understanding the average salaries for a role within a given industry. The more competitive the salary, the more attractive the position is for high performing individuals. By using a salary checking service, you can make sure employees are receiving the right pay rates. This will help reduce turnover as well as attract the best people for any job openings.

Shares

Employee shares schemes are an effective way to incentivize strong performance and improve engagement. Employees who have a financial interest in the company’s success are more likely to offer creative solutions. Offering shares also helps to:

- Give employees a better understanding of business decisions.

- Clarify the company’s mission and core values.

- Attract and retain the best talent.

- Relieve pressure on cash flow.

- Increase loyalty and reduce turnover.

3. Make employee wellbeing a priority

A report from Gallup, Employee Wellbeing Is Key for Workplace Productivity, explores the high costs of poor wellbeing:

- 74% of medical costs accrued mostly due to preventable conditions.

- $20 million of additional lost opportunity for every 10,000 workers due to struggling or suffering employees.

- $322 billion of turnover and lost productivity cost globally due to employee burnout.

- 15% - 20% of total payroll in voluntary turnover costs, on average, due to burnout.

One-off bonus payments and pay rises are great incentives for rewarding high performance over the short term. These can be complemented with other initiatives which focus on addressing issues relating to long-term wellbeing. Combining these initiatives is a good way to enhance the employee experience and make you an employer of choice. Here are some examples of financial initiatives which can be used to improve employee wellbeing.

Holiday pay

It’s no surprise that taking time off work for a well-earned break is great for wellbeing. Yet many employees don’t take all of their holiday entitlement, and as a result lack a healthy work-life balance. Managers should take the time to stress the importance of taking time off to rest. This includes avoiding the urge to check emails or take their work phone on holiday.

Pension

Pensions (otherwise known as 401K in the US) are a vital part of an employee benefits package. When employees know their future retirement is in good hands, they are freed from stress and can focus on improving their performance. Motivating younger employees with pension schemes can be a challenge, with the nature of long-term savings seen as something in the distant future. By linking workplace pensions to issues such as climate change, such schemes are more likely to get the next generation of employees engaged.

Sick pay

Company sick pay is a great way to improve wellbeing through financial incentives. Providing formal support to prevent employee ill-health lets employees know their wellbeing is a priority. Employers who pay above the required statutory sick pay are also more likely to attract and retain the best employees. In addition, offering Occupational Health services to employees can further improve wellbeing and help identify potential health problems.

Insurance

An attractive health insurance package not only helps companies to retain their best employees, it’s also a good way to attract new people to the team. By spreading the risk and lowering the cost per head, employees can get high quality treatment at a fraction of the cost. Such benefits also display a commitment to health and wellbeing, leading to higher productivity and overall job satisfaction.

Employee finances support

The uncertainty surrounding the global economy has led to additional stress for employees. Money worries affect our physical and mental health, lowering our sense of wellbeing and damaging work performance. Offering employees financial support can help relieve this sense of unease and anxiety. Companies can provide this support in a variety of ways, including:

- Helping cover childcare costs. This can include flexible working hours and time off so children can be cared for, as well as helping to subsidize childcare.

- Assisting with housing and utilities. Rental deposit schemes and subsidies can be used to help employees cover the cost of accommodation.

- Travel expenses. Season tickets for public transport, company cars, and fuel cost subsidies can help employees with their budgeting.

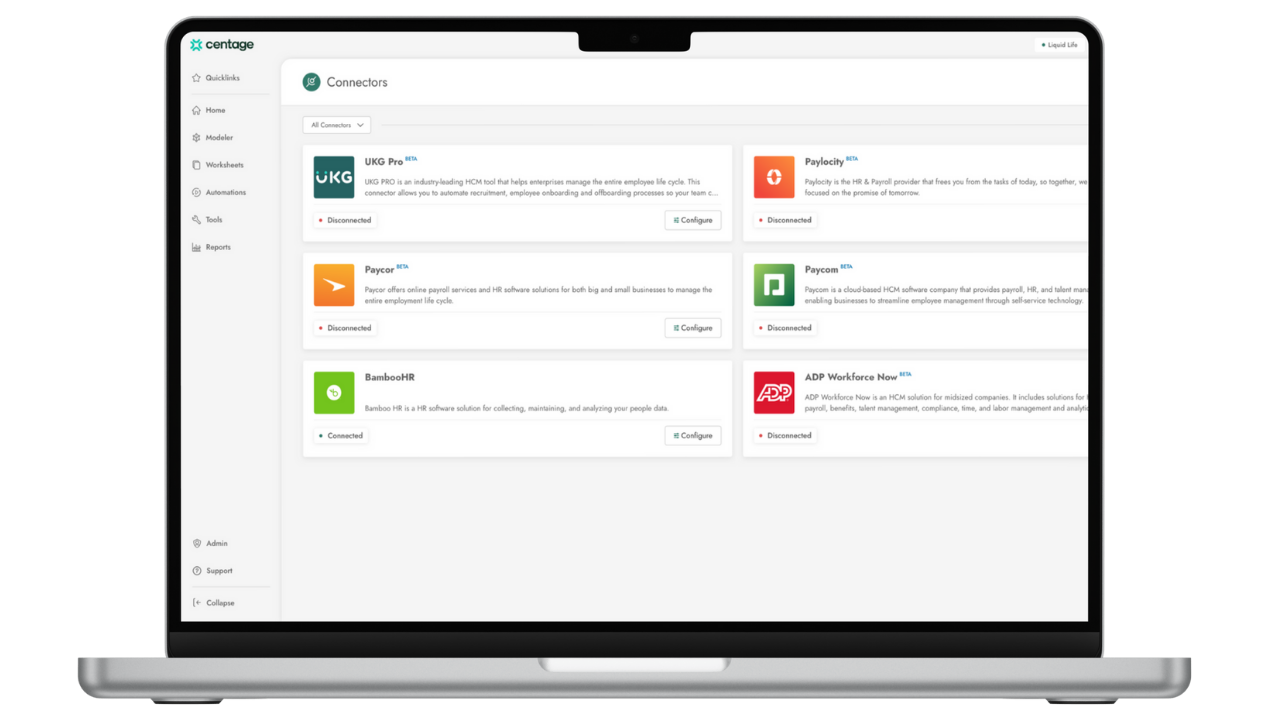

4. Use the right technology

We’ve touched briefly how financial forecasting software can be used along with performance management software to help develop financial initiatives. Let’s explore this technology in more detail.

Payroll capabilities

Choosing a payroll system with a range of capabilities can help create a smooth process for the distribution of financial rewards. Automation features can save your HR team time and money while making sure the roll out of any schemes is a success. In addition to tax filing services and payroll processing, these systems can be a great way to administer compensation. Bonuses, cost of living adjustments and other non-traditional payments can all be processed through the software. Payroll reports can help break down the data to give a high-level view of your company’s budget.

Financial dashboards

Financial performance dashboards give users access to a wide range of data. These are displayed through easy to understand visual reports. Data can be gathered from various systems such as payroll and CRM. Reports on revenue, sales, and other metrics can be directly tied to individuals and departments. This makes sure decisions about financial initiatives are based firmly on the available data.

Scenario planning

Scenario planning is a core feature of financial forecasting software. When setting goals, a range of assumptions are made, from estimated expenses to how long it will take. Once all factors have been considered, the software allows users to predict how they will affect future financial statements. Since scenario planning allows the testing of a wide range of factors, recommendations can be made with confidence. This includes making sure the budget is available for financial initiatives which are designed to create better employee experiences.

Performance Management software

Performance management software is an effective tool for tracking goals. It can also be used to track success on a variety of other measures, including soft skills such as teamwork and leadership. Performance management tools can also offer insights into performance by:

- Highlighting employees who consistently deliver work on time.

- Chart manager-to-peer and peer-to-peer awards and recognition.

- Detail achievement of development objectives.

- Rank employees in a performance leaderboard.

- Tie performance to holidays and sickness.

- Identify performance patterns with employee analytics and reports.

- Gain further insights through 360 degree feedback.

When used with financial forecasting software, these tools deliver a powerful process for rewarding great performance.

Keep reading...

Interviews, tips, guides, industry best practices, and news.