Resources

Blog

Perspectives on financial planning, budgeting, and forecasting.

Read our thoughts on important finance topics for FP&A professionals.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Scenario Planning

Budgeting

Forecasting

July 9, 2025

Why Scenario Planning Is Critical for Resilient CFOs

Workforce Planning

Centage

FP&A Software

May 22, 2025

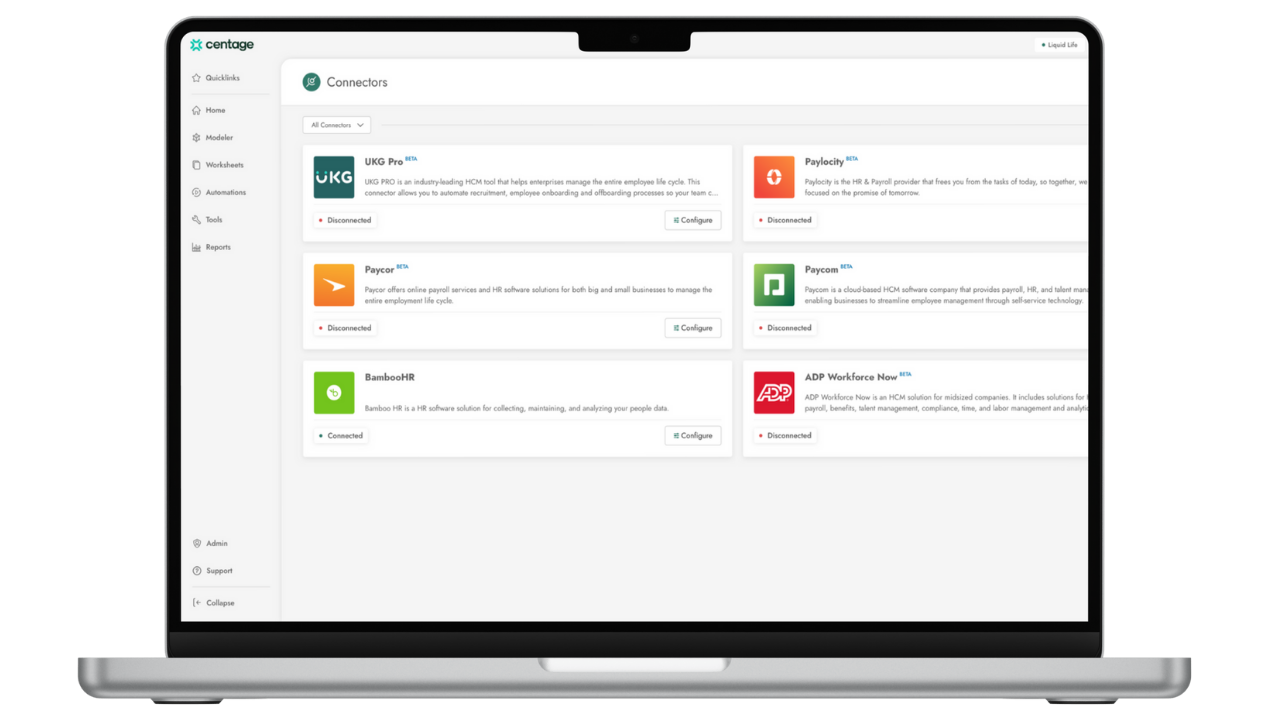

Payroll Integrations Are Live: Real-Time Workforce Data, Zero Spreadsheets

Thought Leadership

Scenario Planning

April 28, 2025

How to Calculate the ROI of AI: A Guide for Finance Leaders (2025 Edition)

Centage

Scenario Planning

Thought Leadership

April 9, 2025

How to Financially Model the Impact of Tariffs (2025 Edition)

Centage

FP&A Software

April 7, 2025

From Spreadsheets to Superpowers: Introducing the New Centage Worksheets

Centage

FP&A Software

Budgeting

Forecasting

Reporting

April 2, 2025

Top 10 Financial Performance Management (FPM) Software Tools for 2025: Features, Comparisons, and How to Choose the Best One

Centage

FP&A Software

Thought Leadership

March 20, 2025

I Crowdsourced the Challenges FP&A Teams Are Having with Excel—Here’s What I Found

FP&A Software

Scenario Planning

Thought Leadership

March 17, 2025

How to Build a Financial Model: A Step-by-Step Guide for Finance Teams

.png)

FP&A Software

Forecasting

February 28, 2025

Smarter Forecasting, Stronger Decisions: How Modern FP&A Tools Drive Success

.png)

Forecasting

FP&A Software

February 20, 2025

Top Financial Forecasting Software Compared: Features, Strengths & Trade-Offs

.png)

Budgeting

Centage

FP&A Software

February 5, 2025

Budgeting Nightmares & How to Avoid Them: Lessons from FP&A Experts

.png)

Budgeting

FP&A Software

January 28, 2025

Budgeting Together: Tools and Best Practices For Collaborative Budgeting

.png)

Scenario Planning

Budgeting

January 2, 2025

New Year, New Goals: 5 Key Priorities for FP&A Professionals in 2025

.png)

Forecasting

FP&A Software

December 11, 2024

Breaking Free from Annual Budgets: Why Rolling Forecasts Are the Future

.png)

Budgeting

Forecasting

Scenario Planning

December 3, 2024

Get Your Master’s in Education Budgeting: A Crash Course for Financial Success

.png)

Budgeting

FP&A Software

Workforce Planning

November 18, 2024

The Budgeting Dojo: Mastering Financial Moves in Manufacturing

.png)

Budgeting

Workforce Planning

Forecasting

November 7, 2024

Don’t Forget This Key Change in Workforce Planning for 2025: New Social Security Wage Base

Budgeting

Forecasting

FP&A Software

November 1, 2024

5 Proven Strategies to Make Budgeting & Forecasting Less Painful for CFOs

.png)

Budgeting

October 29, 2024

Warding Off Financial Frights: Strategies for Secure and Collaborative Budgeting

No Results Found

Reset Filters

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.jpg)