Our Resources

FP&A Insights

Blogs, webinars, and whitepapers to help optimize your FP&A performance.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

FP&A Software

Thought Leadership

Budgeting

November 10, 2025

Breaking Point: How to Know When Your Budget Has Outgrown Excel

Reporting

FP&A Software

November 6, 2025

Simplifying Compliance with Financial Statement Reporting Software

Workforce Planning

FP&A Software

October 9, 2025

Top Workforce Planning Solutions for the Post-Pandemic Economy

Scenario Planning

Budgeting

October 7, 2025

Nonprofit Financial Modeling: Preparing for the Impact of Losing a Major Donor

.png)

Budgeting

Thought Leadership

Centage

October 6, 2025

3 Ways Your 12-Month Budget is Hurting Your Business

.png)

Budgeting

Centage

October 2, 2025

Budgeting with 100 Contributors: How Nonprofits Create Alignment Without Losing Control

Workforce Planning

Scenario Planning

Centage

September 26, 2025

How Strategic Workforce Planning Software Drives HR-Finance Alignment

Scenario Planning

Budgeting

FP&A Software

September 23, 2025

Unlocking Mission Impact Through Unit Cost Modeling: A Guide for Nonprofit Finance Teams

FP&A Software

Workforce Planning

Scenario Planning

September 17, 2025

What to Expect from a Next-Gen FP&A Tool

FP&A Software

Centage

Thought Leadership

September 16, 2025

Podcast Recap: Insights from Our FP&A Advisors

Scenario Planning

Forecasting

FP&A Software

September 10, 2025

The Evolution of Scenario Planning Tools in Modern FP&A

Forecasting

Scenario Planning

FP&A Software

September 3, 2025

Forecasting Patient Volume in Healthcare: Why Service Line Insights Matter for FP&A Leaders

Budgeting

Forecasting

Scenario Planning

August 28, 2025

The Domino Effect: Why Dependencies Matter in Healthcare Budgeting and Forecasting

FP&A Software

Centage

Thought Leadership

August 25, 2025

Podcast Recap: Why FP&A Software Implementation Fails—and How to Succeed Before You Start

Forecasting

Scenario Planning

Centage

August 14, 2025

How to Navigate Cash Flow Gaps in Healthcare Grant Funding

Reporting

FP&A Software

Centage

August 11, 2025

Guide to Consolidated Financial Reporting for Multi-Entities

Thought Leadership

Centage

Budgeting

July 23, 2025

Podcast Recap: CEO & CFO Trust: Insights with Paul Lynch & Jandir Matos

Workforce Planning

Centage

FP&A Software

July 21, 2025

Workforce Planning Tools That Scale With Your Business

Workforce Planning

Centage

Thought Leadership

July 14, 2025

Podcast Recap: What Every CFO Needs to Know About Workforce Planning

Scenario Planning

Budgeting

Forecasting

July 9, 2025

Why Scenario Planning Is Critical for Resilient CFOs

Workforce Planning

Centage

FP&A Software

May 22, 2025

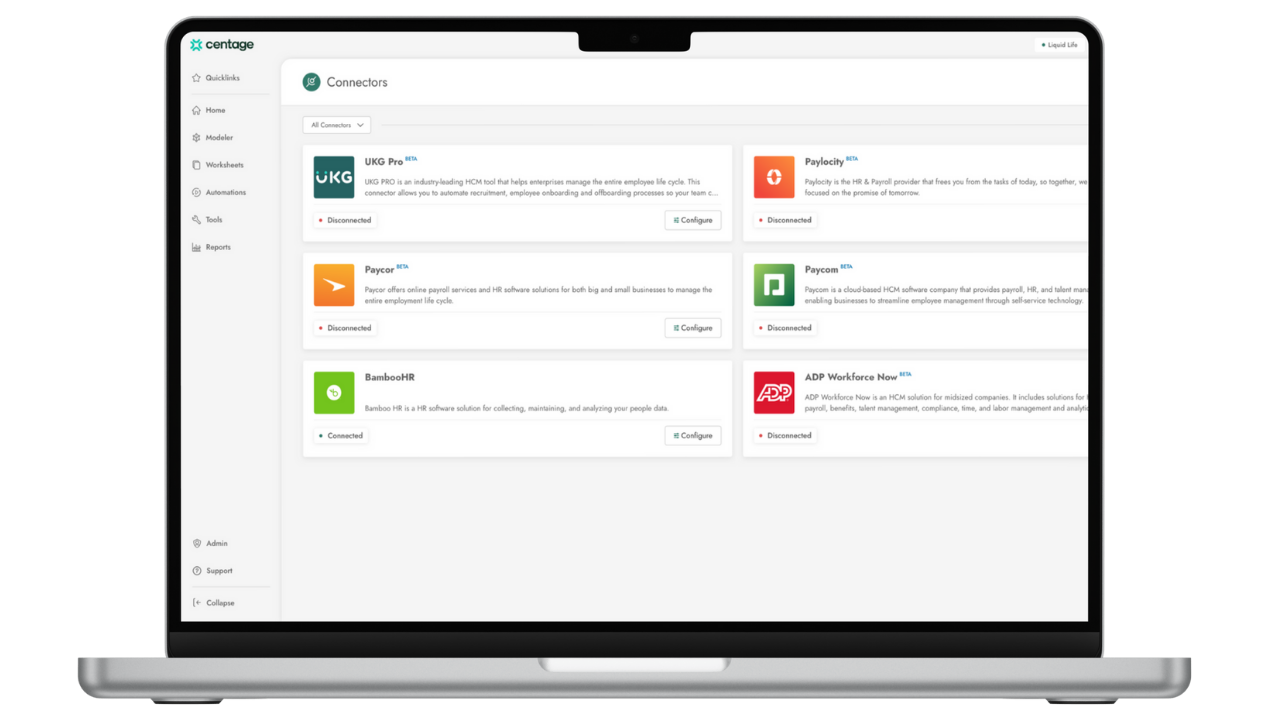

Payroll Integrations Are Live: Real-Time Workforce Data, Zero Spreadsheets

Thought Leadership

Scenario Planning

April 28, 2025

How to Calculate AI ROI: A 2025 Guide for Finance Leaders

Centage

Scenario Planning

Thought Leadership

April 9, 2025

How to Financially Model the Impact of Tariffs (2025 Edition)

Centage

FP&A Software

Budgeting

Forecasting

Reporting

April 2, 2025

Comparing the Top 10 FPM Software Tools for 2025

FP&A Software

Scenario Planning

Thought Leadership

March 17, 2025

How to Build a Financial Model: A Step-by-Step Guide for Finance Teams

.png)

Budgeting

Centage

FP&A Software

February 5, 2025

Budgeting Nightmares & How to Avoid Them: Lessons from FP&A Experts

.png)

Scenario Planning

Budgeting

January 2, 2025

New Year, New Goals: 5 Key Priorities for FP&A Professionals in 2025

.png)

Budgeting

Forecasting

Scenario Planning

December 3, 2024

Education Budgeting 101: A Crash Course for Success

.png)

Budgeting

FP&A Software

Workforce Planning

November 18, 2024

The Budgeting Dojo: Mastering Financial Moves in Manufacturing

.png)

Budgeting

Workforce Planning

Forecasting

November 7, 2024

Key Workforce Planning Update: 2025 Wage Base Changes

No Results Found

Reset Filters

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.jpg)

%20(Large).png)

.jpeg)